Kepler Cheuvreux and Unigestion have entered into a strategic partnership to establish a joint asset management company specialising in quantitative strategies for public equities.

This partnership, which will manage over EUR 3 billion in assets, represents a major milestone in the shared ambition of both groups: to establish a leading player in the liquid asset management market. By combining innovation and complementary expertise, particularly in research and portfolio construction, this initiative will also benefit from Kepler Cheuvreux’s commercial strength.

Strategic synergies for a comprehensive and diversified offering

Backed by strong expertise and a solid track record, the newly formed Kepler Cheuvreux Unigestion Equities entity will leverage the respective strengths of both partners:

On the one hand, Unigestion brings its quantitative and qualitative public equities expertise, enhancing Kepler Cheuvreux’s well-established research capabilities. This partnership merges fundamental and quantitative research approaches, optimising portfolio management while diversifying and expanding the range of investment strategies.

On the other hand, Kepler Cheuvreux contributes its sales force of over 130 professionals and a network of more than 1,300 institutional clients across Europe, the United States, and the Middle East.

A shared identity

This collaboration is built on a common foundation between Kepler Cheuvreux and Unigestion: a strong historical presence in equity markets, deep knowledge of institutional clients’ needs, a longstanding multi-local presence, and an entrepreneurial culture focused on innovation.

Aligned with their shared commitment to responsible investment, both entities integrate ESG criteria into their management processes and maintain an active dialogue with the companies in their portfolios.

A two-step approach

In the first phase, Unigestion will transfer over EUR 3 billion in assets under management in the form of mandates and investment funds, while integrating its entire equities team within Kepler Cheuvreux’s operational infrastructure.

In the second phase, the two partners intend to create a new jointly-owned entity alongside the management team, with the objective of accelerating the development of this business, notably through external growth initiatives.

Laurent QUIRIN, Chairman of the Supervisory Board at Kepler Cheuvreux and Bernard SABRIER, Executive Chairman of the Board at Unigestion stated:

“This partnership is driven by a shared ambition: to provide institutional investors with sophisticated, innovative solutions tailored to the evolving market landscape. The combination of Unigestion’s quantitative expertise with Kepler Cheuvreux’s research, execution and distribution capabilities, enables us to unlock unique synergies and offer a distinctive, high-value proposition.”

This transaction is subject to regulatory approval.

About Kepler Cheuvreux

Kepler Cheuvreux is a leading independent European financial services company that specialises in Research, Execution, Fixed Income and Credit, Structured Solutions, Corporate Finance, and Asset Management.

The group employs around 600 people and is present in 14 major financial centres in Europe, the US, and the Middle East: Amsterdam, Brussels, Dubai, Frankfurt, Geneva, London, Madrid, Milan, New York, Oslo, Paris, Stockholm, Vienna, and Zurich.

Group key figures:

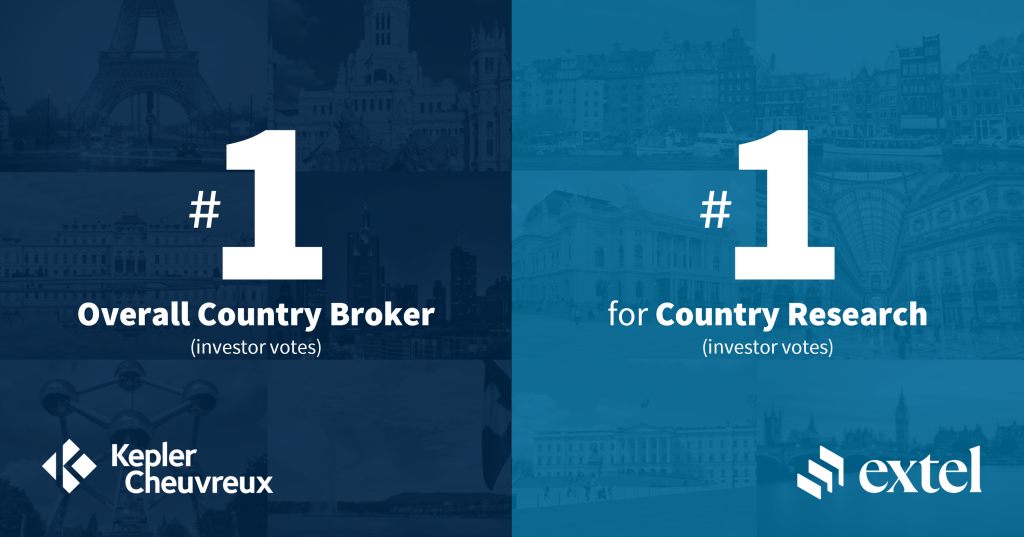

- 1st independent European equity broker.

- 1st Equity Research coverage in Continental Europe.

- 1st Country Broker and Research (Extel 2024).

- 14 major financial centres in Europe, the US, and the Middle East.

- 600 employees.

- 1,300 institutional clients.

- EUR4.7bn in assets under management for its subsidiary Ellipsis Asset Management (at 31 January 2025).

About Unigestion

Unigestion is an international boutique asset manager with $15bn* in assets under management and 10 offices across Europe, North America and Asia. For more than 50 years we have provided innovative investment solutions for institutional clients and high net worth individuals worldwide.

We believe that intelligent risk-taking is key to delivering consistent returns over time. This core conviction underpins our investment approach across our private equity, equities and wealth management businesses.

Unigestion’s ownership structure ensures our business is aligned with the needs of our stakeholders. Our largest shareholder is the Famsa Foundation, a Swiss foundation established by our Chairman Bernard Sabrier in 2011 to make substantial contributions to a wide range of projects in the charitable, educational, cultural and medical fields. Employees and clients are also represented as shareholders.

*Source: Unigestion 31.12.24